US semiconductor designer Advanced Micro Devices (AMD) has agreed buy Xilinx, another American chipmaker, in a $35 billion all-stock deal, it said on Tuesday.

Written content via Reuters via Business Insider

The deal, which AMD expects to close at the end of 2021, would create a combined firm with 13,000 engineers and a completely outsourced manufacturing strategy that relies heavily on Taiwan Semiconductor Manufacturing Co (TSMC).

It will intensify AMD’s battle with Intel Corp in the data center chip market. Both AMD and Xilinx have been able to grab market share from Intel, which has struggled with internal manufacturing.

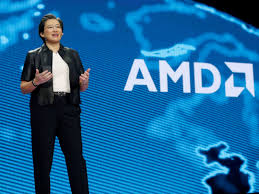

AMD has long been Intel’s chief rival for central processor units (CPUs) in the personal-computer business. Since Chief Executive Lisa Su took over AMD in 2014, she has focused on challenging Intel in the fast-growing business of data centers that power internet-based applications and services.

Xilinx has also been working to penetrate data centers, with programmable processors that help speed up specialized tasks, such as compressing videos or providing digital encryption.

Its primary rival in the area, Altera Corp, was scooped up by Intel for $16.7 billion in 2015 in what was then Intel’s largest-ever deal.

The tie-up comes at a time when Intel’s manufacturing technology has fallen years behind TSMC’s.

AMD, which spun off its factories nearly a decade ago, has rocketed ahead of Intel with chips that perform better. The performance edge helped AMD gain its best market share since 2013 at slightly less than 20% of the CPU market, which has in turn pushed its shares up 68% between the start of the year and the close of trade on October 26.

Xilinx also uses TSMC’s factories to make its chips, with both US companies using modular designs that let them swap out different pieces of a chip to avoid delays.

AMD’s Su will lead the combined company as chief executive, with Xilinx CEO Victor Peng serving as president responsible for the Xilinx business and strategic growth initiatives. The companies expect the deal to generate $300 million in cost savings. Read more from Business Insider.